- ResiClub

- Posts

- Zoodealio-ResiClub Real Estate Agent Survey Q4 2025 results, as told by 13 charts

Zoodealio-ResiClub Real Estate Agent Survey Q4 2025 results, as told by 13 charts

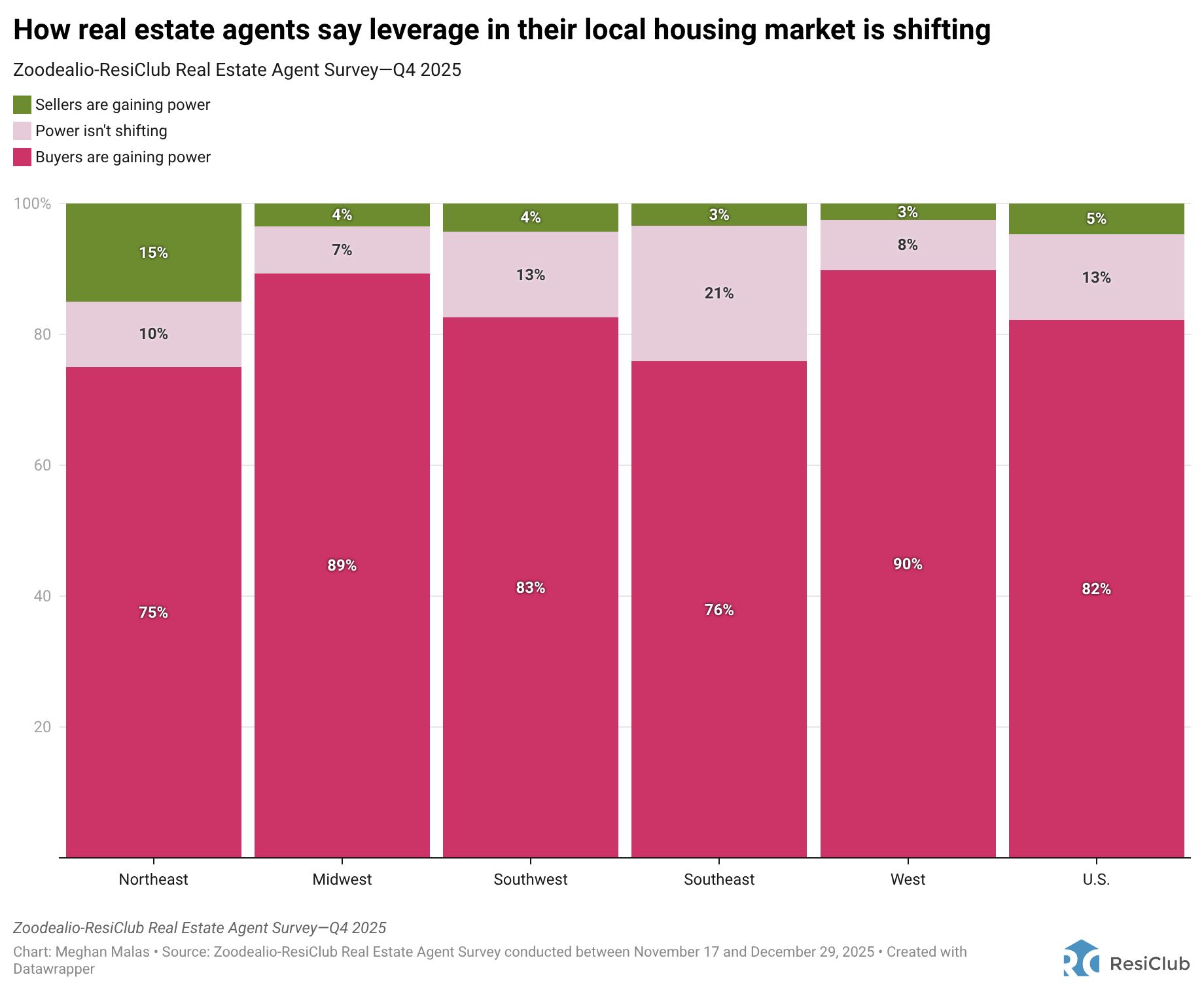

Among U.S. real estate agents we surveyed, 82% say buyers are gaining leverage in their local housing market—that share is even higher among agents based in the West (90%).

Today’s ResiClub letter is brought to you by Lennar Investor Marketplace!

When you invest with Lennar, you’ll be connected with reputable property managers who handle tenant placement, repairs and ongoing maintenance. Lennar partners with experienced and qualified property management firms nationwide. Through these partnerships, you can access pre-negotiated rates that average between 6% and 6.5% for the base property management fee, compared to the standard average of about 10% for individual investors. Additional benefits include waived management fees for the first few months, significant savings on leasing and renewal fees, and expert guidance in choosing the best management firm for your property.

Join today to unlock your access to Lennar’s exclusive property management partnerships.

In today’s article, we’re sharing the full results from the Zoodealio-ResiClub Real Estate Agent Survey—Q4 2025. To conduct our real estate agent survey, ResiClub partnered with Zoodealio, a cash-offer platform and iBuyer-management software designed for real estate agents.

Among the 204 agents who took the survey, half (51%) have been real estate agents for 15 years or longer.

The survey was fielded between November 17 and December 29, 2025. Respondents included real estate agents spanning all regions of the U.S., giving us a ground-level view of buyer urgency, seller motivation, leverage shifts, commission structures, and expectations for the next 12 months.

Here’s what the results revealed:

Buyer urgency cools, and leverage continues to shift away from sellers

Nationally, a majority (55%) of agents say buyer urgency is lower than 12 months ago. The pullback is most pronounced in the Southwest, where no agents reported seeing buyer urgency pick up, and 65% reported seeing lower urgency.

This slowdown is underlined by a continued downturn of buyer demand, with 52% of U.S. agents reporting lower homebuyer demand relative to 12 months ago.

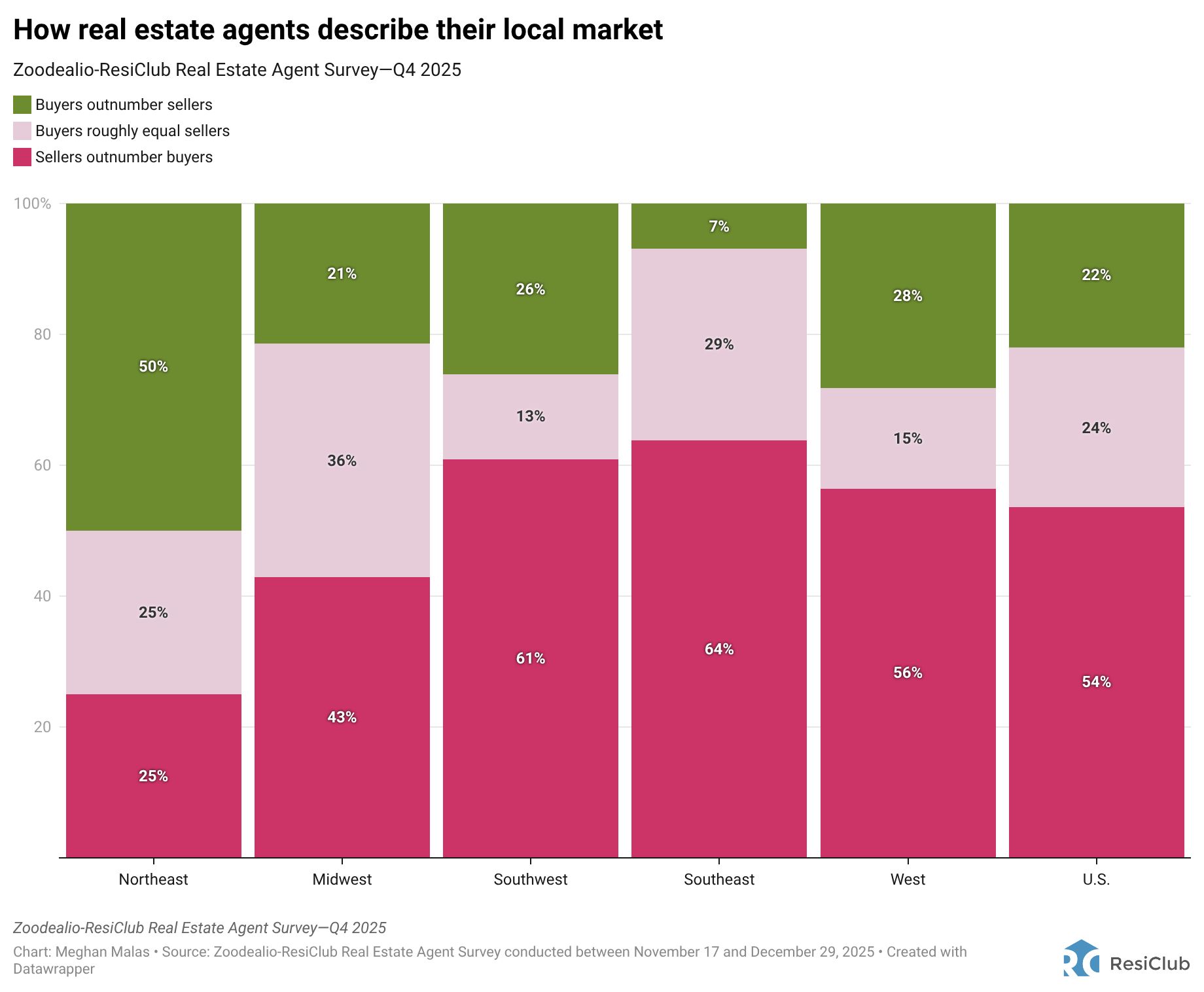

As buyer demand softens and inventory continues to build, 54% of U.S. agents now say sellers outnumber buyers, with 64% of agents in the Southeast noting the trend, reinforcing that buyers are gaining negotiating power as they move less urgently.

Moreover, the overwhelming majority of agents across all regions (82%) agree that the leverage continues to shift towards homebuyers in their local housing markets.

As buyer urgency fades, seller urgency is rising. Nationally, 45% of agents say seller urgency is higher than it was 12 months ago, led by the West (51%), Southwest (48%), and Southeast (46%). In these regions, fewer sellers appear willing to wait for conditions to improve.

By contrast, the Northeast looks more stable: 55% of agents there say seller urgency is about the same as a year ago.

Agent’s 2026 expectations

In Q4 2025, 39% of agents surveyed expected home prices in their local market to increase over the next 12 months, up from 28% in Q3. The shift is driven by a rise in expectations for prices to stay flat or see slight appreciation, with only 2% of agents anticipating price increases of 5% or more.

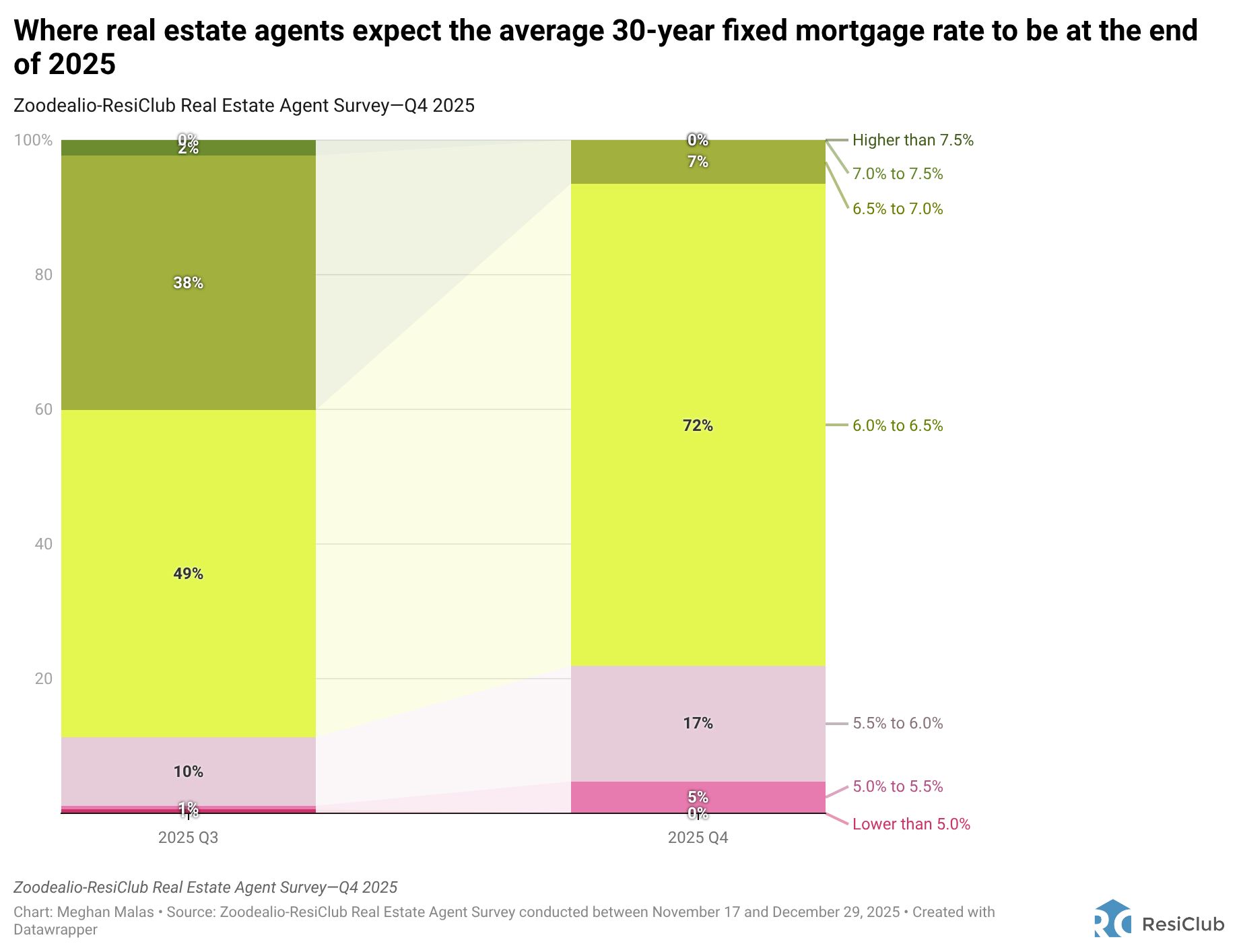

Mortgage-rate expectations have dipped lower over the past quarter. Earlier in the year, many agents were still bracing for a higher-rate outcome by the end of 2025. As the year progressed, that view softened: throughout Q4, most agents reported their expectations shifted toward a mid-6% endpoint, with far fewer expecting rates to remain in the 7% range.

Overall confidence is weak, but agents see growth coming from existing homeowners

Among real estate agents surveyed, 60% of agents describe their business outlook for the next 12 months as optimistic, led by agents in the Southeast (67%).

Where do agents think the pie can grow the most in 2026? They say homeowners looking to downside..

Roughly 43% say downsizers will be the fastest-growing client segment, followed by move-up buyers (20%). First-time buyers trail well behind (15%), reflecting ongoing affordability constraints.

Agent commissions are holding up—but they’re still mad at NAR

Sentiment toward the National Association of Realtors remains weak: 57% of agents describe their view as somewhat unfavorable (26%) or very unfavorable (31%), while only 13% express a somewhat favorable (10%) or very favorable opinion (3%) of the organization.

Agent compensation structures remain largely similar to the way they were prior to the March 2024 National Association of Realtors settlement: 88% of sell-side deals and 82% of buy-side deals still use fixed-percentage commissions, mostly in the 2% to 3% range. Alternative structures are more common on the buy side but remain a minority.

Meanwhile, about 10% of U.S. agents say they have discussed iBuyer cash-offer options with clients “very often” in the past year. These conversations are most common between agents and clients in the Southwest and the Southeast.

Big Picture

Relative to the Q3 survey, the Zoodealio-ResiClub Real Estate Agent Survey results from Q4 2025 show a market moving in the same direction, but with more clarity. Buyer urgency has cooled further, seller urgency has picked up, and the majority of agents say sellers outnumber buyers, reinforcing the ongoing shift in negotiating power toward buyers.

At the same time, expectations around home prices have firmed modestly, with fewer agents anticipating declines and more expecting flat to slight growth in the next 12 months. As in Q3, agents expect activity to be driven primarily by existing homeowners—particularly downsizers and move-up buyers. Meanwhile, post-settlement agent sentiment toward NAR remains poor, and commission structures remain largely unchanged.