- ResiClub

- Posts

- Austin and Denver boast ‘significantly oversupplied’ lot inventory—Baltimore and Philly homebuilders still struggle to find lots

Austin and Denver boast ‘significantly oversupplied’ lot inventory—Baltimore and Philly homebuilders still struggle to find lots

Zonda chief economist Ali Wolf: "Builders have scaled back starts in response to slower sales, which by extension has allowed for lot supply to grow."

Today’s ResiClub letter is brought to you by the Lennar Investor Marketplace!

Searching for markets with strong rental demand? As an SFR investor, the ability to choose from Lennar ’s vast network of more than 90 markets nationwide is a significant advantage. With such a wealth of options, you can more easily find properties that align with your specific investment goals, whether you're aiming for higher cash flow, top-rated schools or long-term equity growth. The Lennar Investment Marketplace platform simplifies the search for the right investment by offering detailed insights into each area, along with projected rental returns for its 2,000+ curated homes. Every property is move-in ready and has been thoroughly vetted for legal compliance, financial performance, and rental demand so you can confidently grow your portfolio in major rental regions across the country.

Join today to access Lennar ’s curated properties in 90+ high-demand rental markets.

During the Pandemic Housing Boom, we saw red-hot housing demand quickly absorb much of the available slack in the housing market. Back in 2021, active housing inventory for sale, unsold completed new builds, and available lot supply all plunged to historic lows.

But ever since the Pandemic Housing Boom fizzled out in mid-2022, housing slack has been building back up in the housing market—especially in certain pockets of the Sun Belt.

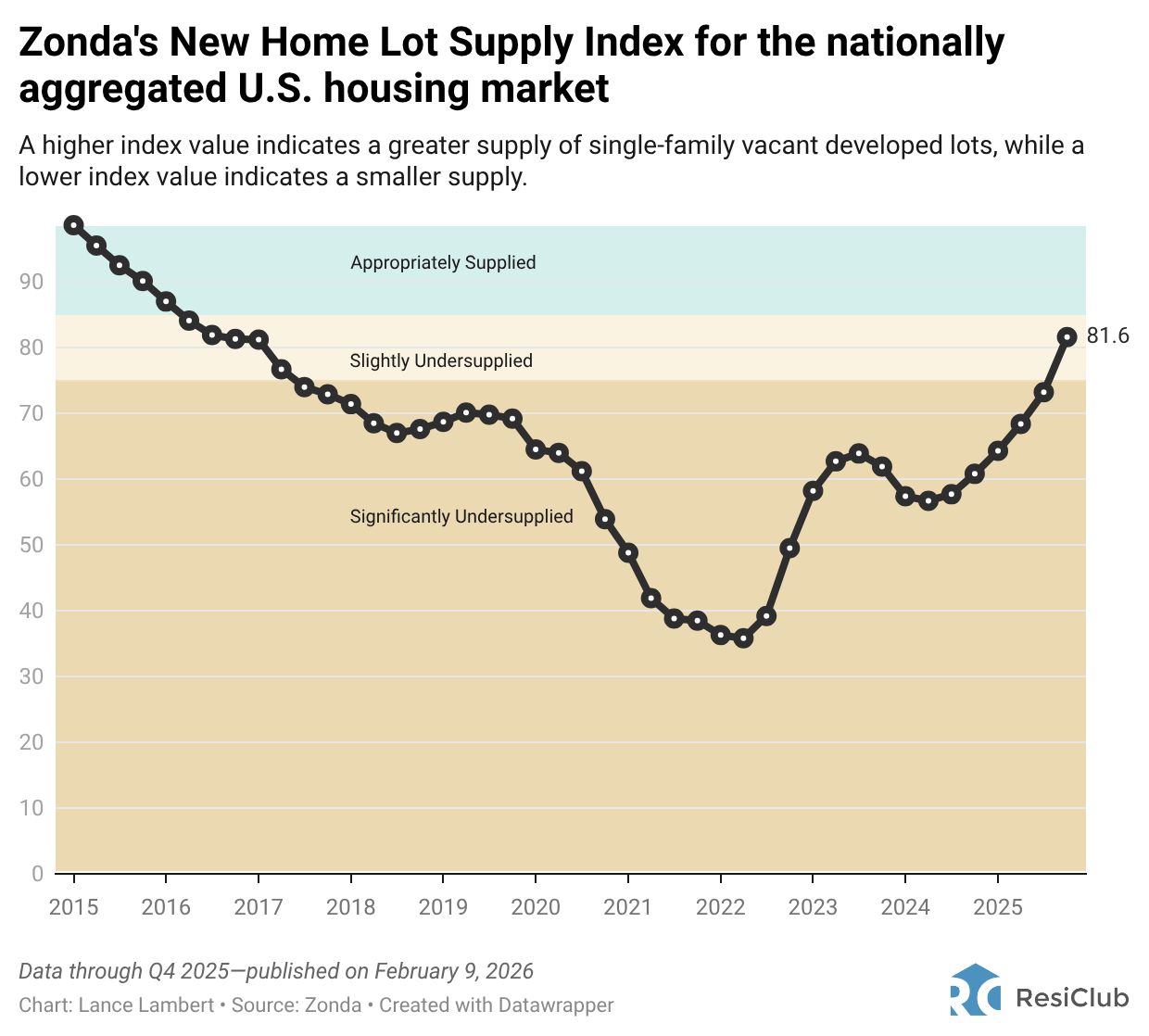

Look no further than Zonda’s New Home Lot Supply Index, which measures lot supply based on the number of single-family vacant developed lots and the rate at which those lots are absorbed via housing starts. A higher index value indicates a greater supply of single-family vacant developed lots, while a lower index value indicates a tighter lot supply/new construction market.

That index reading for Q4 2025 climbed to 81.6—well above the all-time low of 35.8 set at the height of the Pandemic Housing Boom in Q2 2022, when builders were buying as much entitled land as they could find.

According to Zonda, homebuilder lot supply loosened/rose in 28 of the 30 major metro area housing markets tracked over the past 12 months.

Housing markets like Austin, Atlanta, Denver, Dallas, L.A., Seattle, and Jacksonville experienced some of the most significant year-over-year loosening of lot supply.

That said, despite an uptick in available lots in some markets on a year-over-year basis, around half of major housing markets are still what Zonda considers “significantly undersupplied.”

Zonda’s New Home Lot Supply Index has 5 groupings:

“Significantly oversupplied” = 125 score or higher

“Sightly oversupplied” = 115-125 score

“Appropriately supplied” = 85-115 score

“Slightly undersupplied” = 75-85 score

“Significantly undersupplied” = 75 score or lower

One year ago, just three major metro housing markets were “appropriately supplied” in terms of lot/land supply—Austin, Atlanta, and Dallas—and none were classified as “slightly oversupplied” or “significantly oversupplied.”

Fast-forward to the latest reading, and 10 of the 30 markets now fall into the “appropriately supplied” category or higher.

If Zonda had published data for more than 30 markets, my assumption—based on my own analysis—is that many pockets of Southwest Florida (including Cape Coral and Punta Gorda) would have ranked near the top.

“Policy uncertainty, the current cost of living, student loans, labor market concerns, interest rates, home prices, changes to immigration, geopolitics, and more have all slowed consumer demand. When consumers aren’t happy, builders aren’t happy, and that’s exactly what we are seeing in the data. Builders have scaled back starts in response to slower sales, which by extension has allowed for lot supply to grow.”

Brad Jacobs’ building materials roll-up continues with $2.25B Kodiak Building Partners purchase

On Wednesday, QXO—the building products materials giant that billionaire Brad Jacobs is forming—announced that it has reached an agreement to buy Kodiak Building Partners for $2.25B. Kodiak is a distributor of "lumber, trusses, windows/doors, construction supplies, waterproofing, roofing."

Around 40% of Kodiak’s business comes from builders in Texas and Florida. QXO says it expects the deal to close in Q2 2026.

“The acquisition of Kodiak is highly complementary to our existing business. We’ll be able to deliver more value to customers across our combined base by cross-selling products and support services, and with a greater presence in key markets. And we expect the integration to accelerate margin expansion through scaled procurement, network optimization, AI-powered inventory management, and other tech-enabled operating efficiencies. Our acquisition pipeline remains very active, with plenty of dry powder from our recently announced equity financings led by Apollo and Temasek.”

Back in October 2023, ResiClub spoke with Jacobs, and he outlined how he planned to use his tried-and-proven business playbook to build a juggernaut in the building products space.

“I’m going to build a large building products distributor… I’ve started seven companies that all became billion or multi-billion dollar companies… I want the advantage of size, economies of scale. I want to be able to lower costs.”

“There are $20 and $30 billion dollar players already. Builders FirstSource, you got Ferguson. Great companies, real fine companies. But I’m planning to do something larger than that.”

“Primarily through acquisitions [is how I plan to build it]. If you look at my background, the teams I’ve led have done 500 acquisitions. M&A [mergers and acquisitions] is a tool in my tool kit I’ve used quite a bit. I think there’s a lot of room for creative M&A in the building products distribution space. The market is highly fragmented. You have 7,000 distributors here in North America, and almost twice that 13,000 in Europe. Most of them are private.”

Acquisitions in the building materials space have accelerated since billionaire and serial entrepreneur Jacobs entered the market and launched QXO. Some of these acquisitions are being made by QXO—others are by established giants in the industry that seemingly are trying to fend off QXO’s ascent.

March 2025 -> QXO acquisition of Beacon Building Products for $11 billion

June 2025 -> The Home Depot acquisition of Gypsum Management and Supply for $5 billion (QXO was trying to acquire GMS)

August 2025 -> Lowe's to buy Foundation Building Materials for $8.8 billion