- ResiClub

- Posts

- Understanding institutional landlord Invitation Homes’ new housing market bet

Understanding institutional landlord Invitation Homes’ new housing market bet

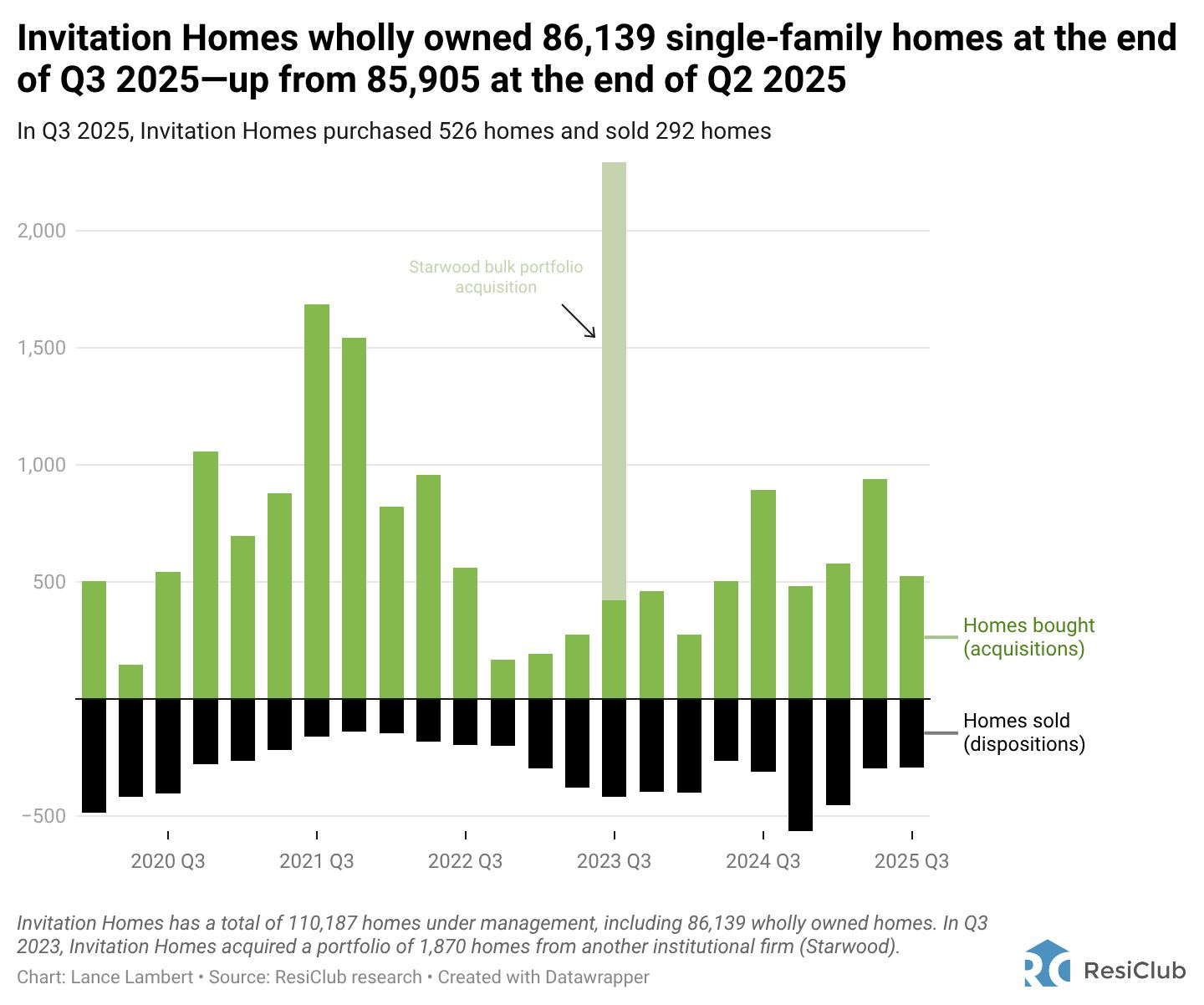

Invitation Homes—which wholly owns 86,139 single-family rentals—announced Thursday that it is acquiring build-to-rent developer ResiBuilt. Here’s why that matters.

Today’s ResiClub letter is brought to you by the Lennar Investor Marketplace!

It’s easy to overlook the advantage of investing in a home constructed to current building codes that specifically address today’s climate realities. New homes on the marketplace incorporate advanced weatherization, improved drainage systems and energy-efficient designs. As an investor, you’ll save on repair and maintenance costs in the long-term. Plus, improving energy efficiency means that residents will save every year on energy-related costs— and that translates directly to your investment performance. Find a brand-new home constructed with the latest building codes on Lennar Investor Marketplace’s selection of more than 2,000 curated properties in 90+ growth corridors nationwide. Access Lennar's one-stop shop of unique benefits, making it easier to maintain your property seamlessly.

Join Lennar Investor Marketplace to browse new construction and start investing today.

Invitation Homes makes new build-to-rent bet

Invitation Homes—one of the largest institutional landlords, which wholly owns 86,139 single-family rentals—announced Thursday that it has acquired ResiBuilt, a Southeast-focused build-to-rent (BTR) developer, for $89 million.

Atlanta-based ResiBuilt has delivered more than 4,200 homes since its founding in 2018 and operates across Georgia, Florida, and the Carolinas. The transaction includes 23 existing fee-build contracts and a pipeline of additional third-party development opportunities. Invitation Homes also secured options on approximately 1,500 lots.

The development here isn’t that Invitation Homes is adding new-build homes to its portfolio—it has been executing bulk deals with homebuilders for years—but that it is now moving upstream by creating its own in-house homebuilder via its acquisition of ResiBuilt, a build-to-rent developer.

“This move strengthens Invitation Homes’ competitive position in the high‑growth BTR and single‑family rental markets while maintaining a capital‑light model. In this environment in which SFR is facing political headwinds, expanding their BTR capabilities is an astute move.”

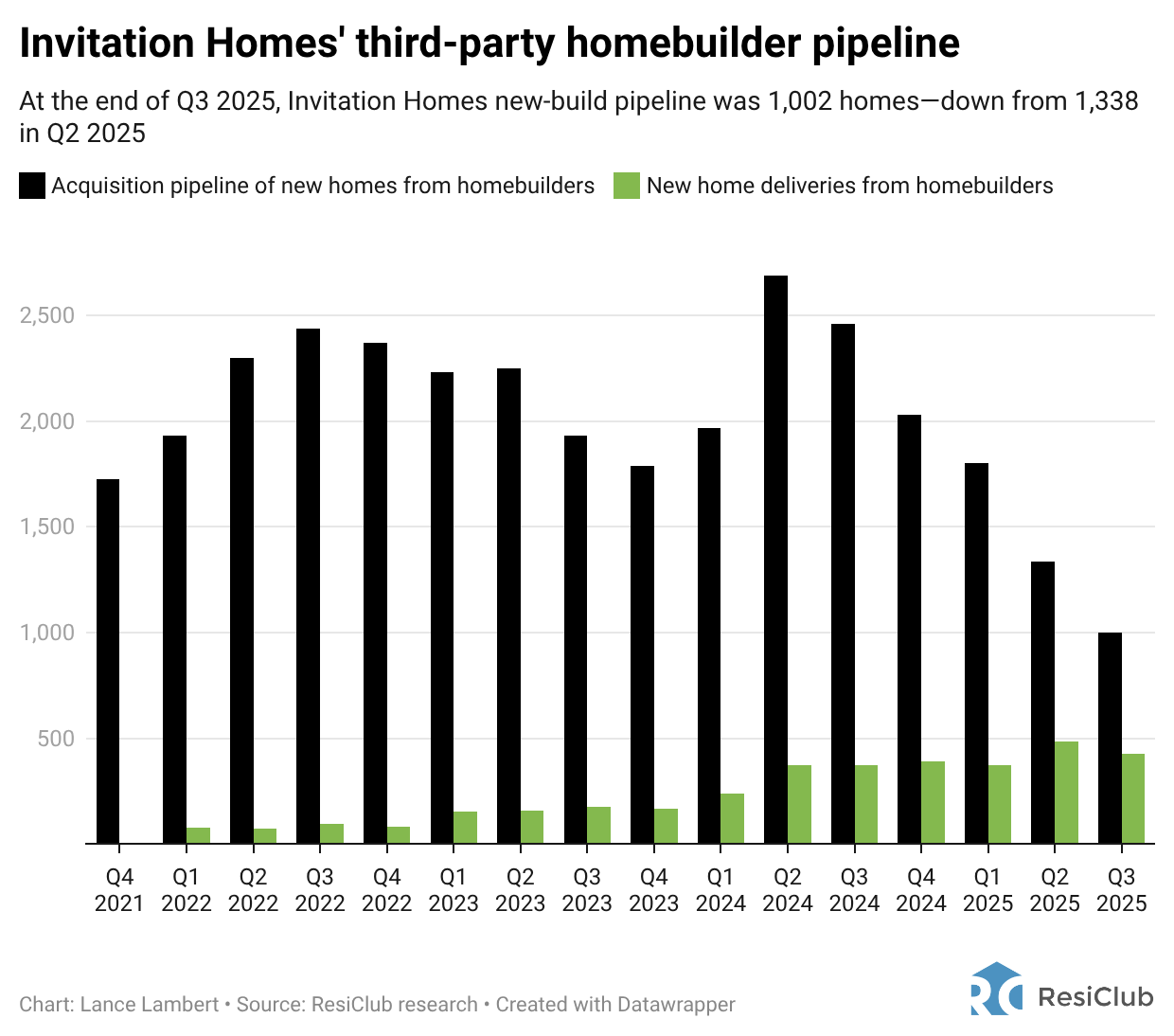

Back in 2021, Invitation Homes struck a deal with PulteGroup and began buying build-to-rent homes. In Q3 2025, third-party homebuilders delivered 426 homes to Invitation Homes—and have another 1,002 in the pipeline (see chart above).

Those 426 new builds accounted for 81% of the total 526 single-family acquisitions Invitation Homes made last quarter (see chart below). The share of new builds in Invitation Homes’ total acquisitions has also been boosted by a pullback in scatter-site buying, as many large landlords—including Invitation Homes—have scaled back resale-market acquisitions following the spike in interest rates and the resulting compression in yields.

“We are also evaluating alternatives to add development as another growth channel, whether through merchant build partnerships or in-house development capabilities.

A quick note on our MLS channel. We're not buying significant volume on the MLS right now. We're closely monitoring resale home pricing. We're very attuned to where the resale market is. We're standing by to see if this market becomes actionable and accretive to our cost of capital, but volumes have not increased materially and we haven't seen a move in cap rates yet, but we're watching this closely.

The rise of homebuilder supply is leading to acquisition opportunities for us. As you can see here, homebuilder standing inventory per community has risen to 2.5 homes per community, which is the highest level of inventory you've seen with the homebuilders since 2011. With mortgage rates at 6% with a high cost of insurance, the cost of ownership to own a home is still unaffordable. Homebuilders today, as we said, they're working through excess inventory. They're slowing down their future commitments. We are acting as a liquidity provider to the homebuilders. The same way we act as a liquidity provider to the resale market 10 years ago. The current market is providing some very attractive entry points for us to deploy capital at strong risk-adjusted returns.”

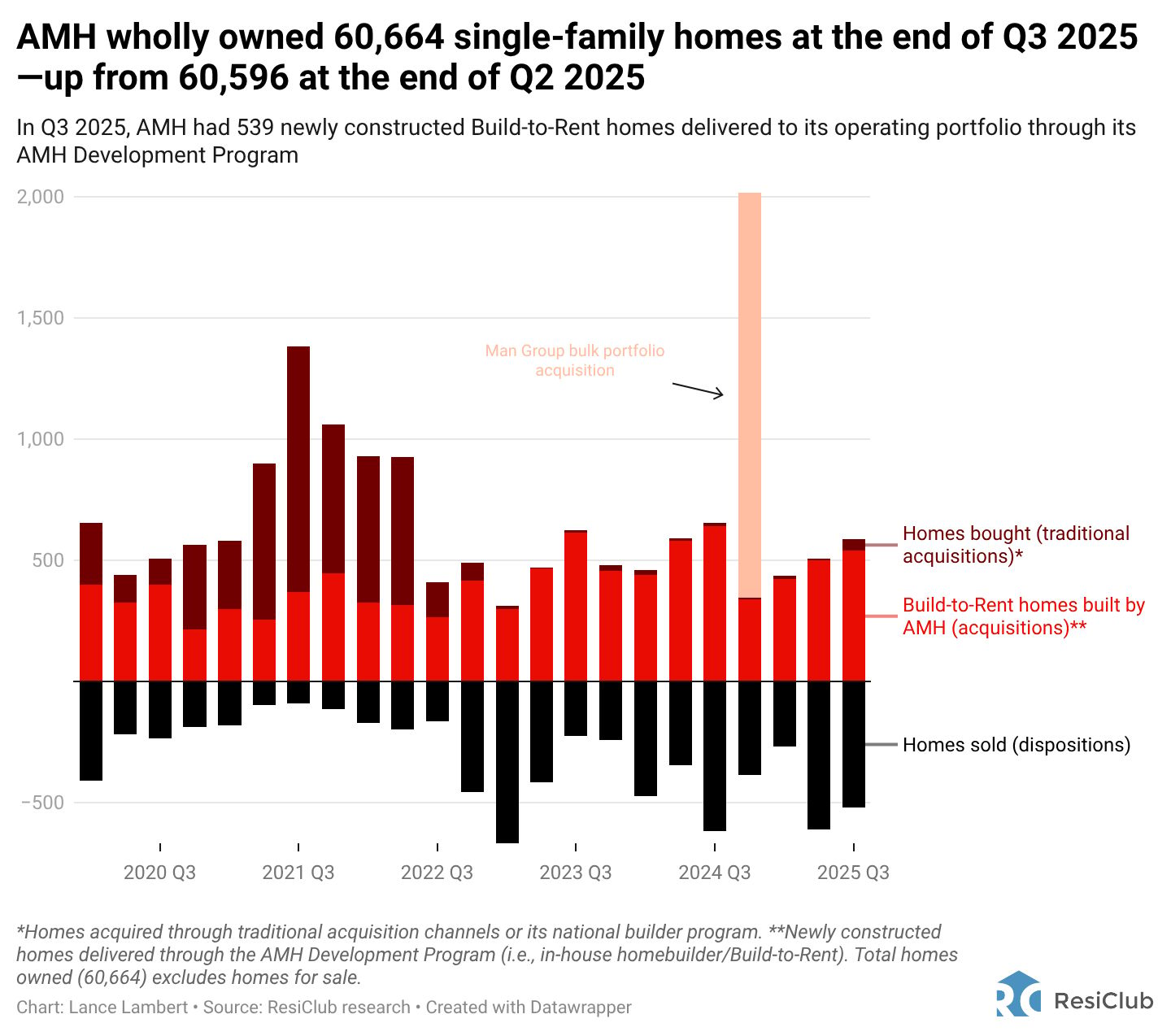

Invitation Homes buying ResiBuilt signals that it’s doubling down on build-to-rent. That said, an institutional landlord creating its own in-house homebuilder to supply itself rental units isn’t a new concept—it’s essentially the AMH playbook.

Over the past few years, AMH has shifted much of its acquisition strategy away from scatter-site homebuying—buying individual homes to be used as rental properties—and is instead focused on build-to-rent, constructing entire communities specifically to be rented out rather than sold.

In Q3 2021, AMH acquired 1,014 homes, with 358 coming from its in-house homebuilder—accounting for 27% of its acquisitions.

In Q3 2025, AMH acquired 587 homes, with 539 coming from its in-house homebuilder—accounting for 92% of its acquisitions.

In total, AMH has a portfolio of 60,664 wholly-owned single-family rentals. Of those rental homes, more than 10,000 were built by AMH’s in-house homebuilding/build-to-rent operation.

Back in summer 2024, ResiClub spoke with Brent Landry, head of the AMH Development program—the company’s in-house homebuilding unit launched in 2017. According to Landry, here are the three main advantages of creating an in-house homebuilding operation rather than simply partnering with and buying from traditional homebuilders:

Control over quality, design, and product: By developing their own homes, Landry says AMH can ensure that the properties meet their standards for quality and design, making them more attractive to the renters they’re targeting.

Scalability: Owning the build-to-rent process allows AMH to scale their operations more efficiently.

Long-term thinking: Developing new communities allows AMH to strategically select locations and develop properties that are likely to have the best long-term outlooks.

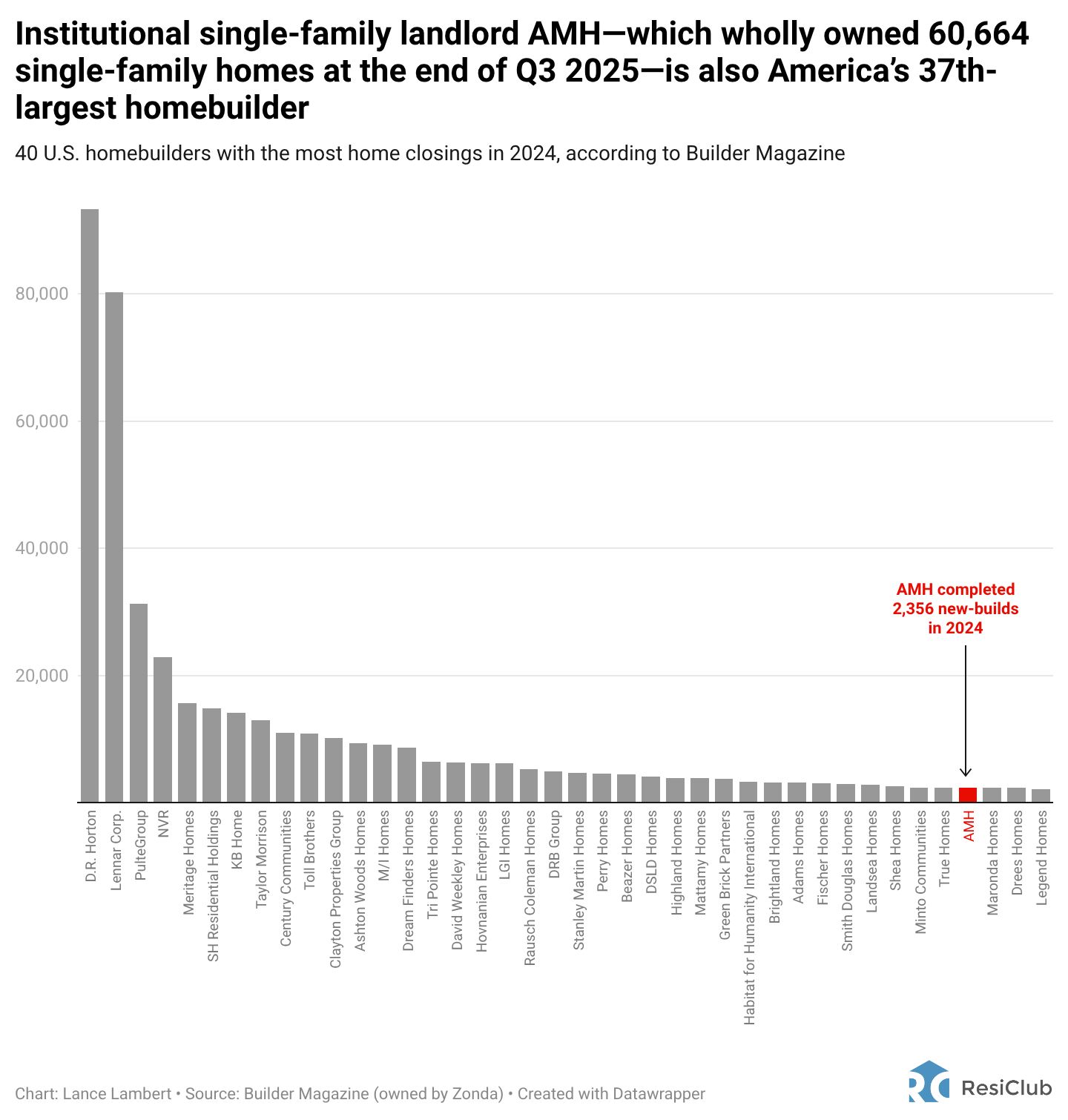

AMH’s in-house BTR unit has gotten so big, that according to the latest Builder 100 ranking, AMH is now the nation’s 37th largest homebuilder.

The elephant in the room, of course, is that Invitation Homes announced its acquisition of build-to-rent developer ResiBuilt just days after President Donald Trump said he is working to “ban large institutional investors from buying more single-family homes.”

Aside from questions about whether this is merely midterm-year politicking or if it could actually pass legal challenges, another key question right now is whether Trump’s proposed institutional ban would apply only to institutional scatter-site purchases (i.e., buying existing homes on the market) or also to build-to-rent development (i.e., building communities and homes specifically for rent). Some in the industry believe policymakers may be less willing to attempt to ban or limit institutional build-to-rent activity, given that it adds net new housing supply.

However, the day after Trump posted about the proposed institutional ban, FHFA Director Bill Pulte suggested they’d put pressure on build-to-rent as well. We’ll have to wait and see how it plays out.

“They [institutional landlords] are also buying a lot of homes from the homebuilders. And it’s our opinion—certainly my opinion—that new homes should go to people, not to corporations."

"There has been this whole thing also where corporations have been able to get better deals from homebuilders. Homebuilders need to be focused on providing homes for people, not for corporations… I would encourage people to not engage in this type of behavior. We have a lot of tools we can utilize. It’ll be up to the president to decide what if any he wants to use with Fannie and Freddie. But we stand ready to make sure this happens."

Over the past week, ResiClub members (paid tiers) got these 3 additional housing research articles:

Two bonus charts:

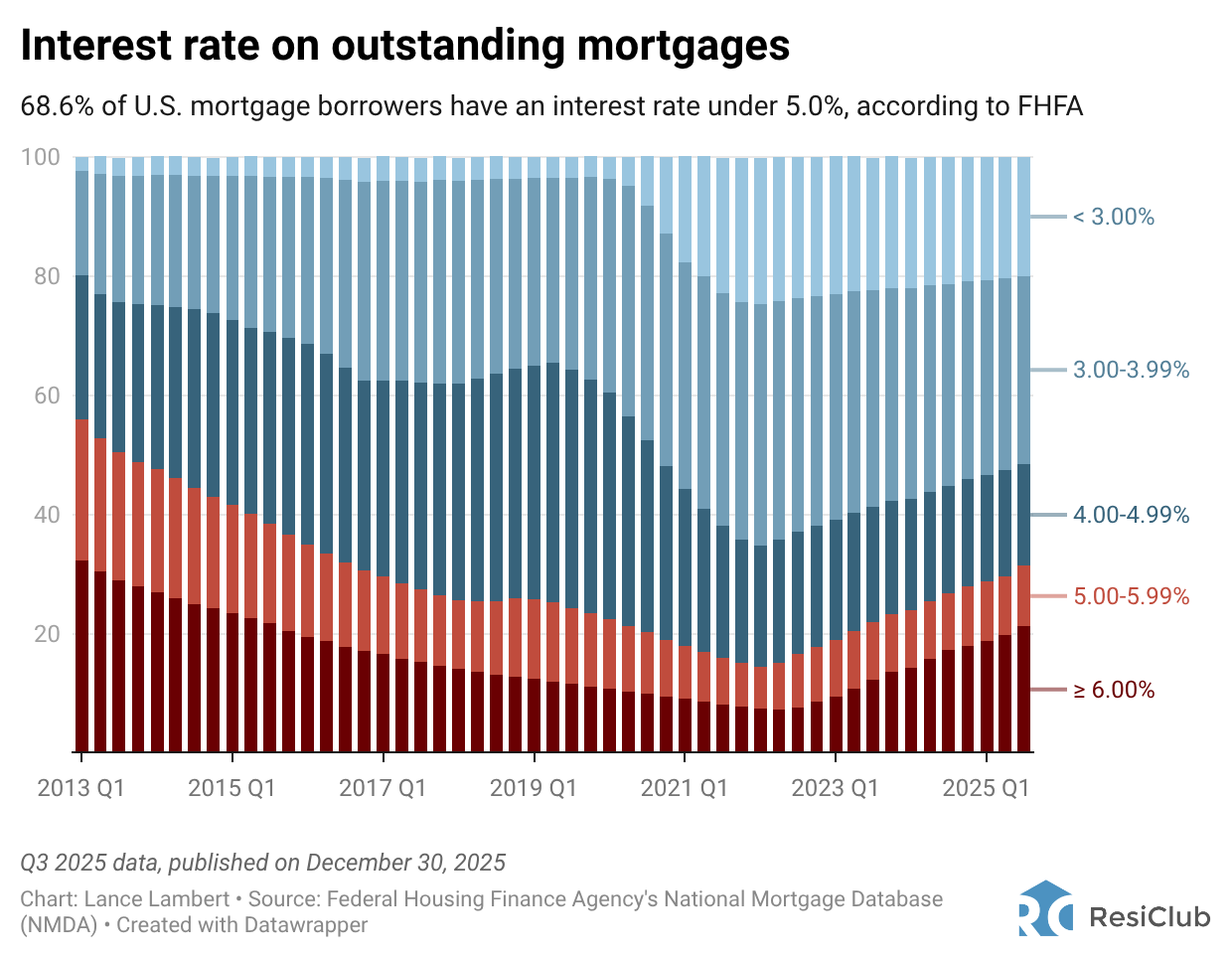

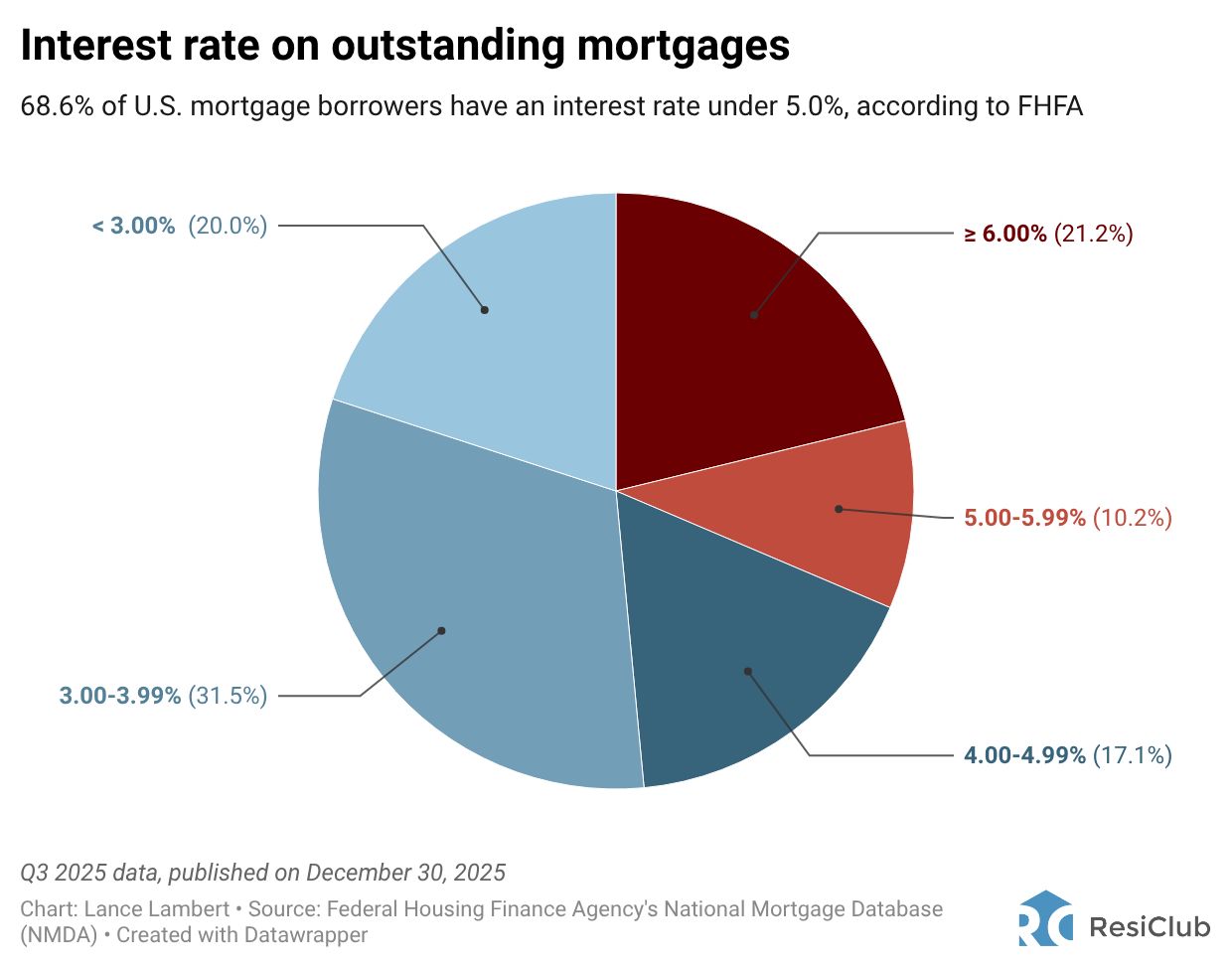

At the end of the last reported quarter, the share of U.S. mortgage borrowers with an interest rate over 6.0% has finally exceeded the share of U.S. mortgage borrowers with an interest rate below 3.0%.