- ResiClub

- Posts

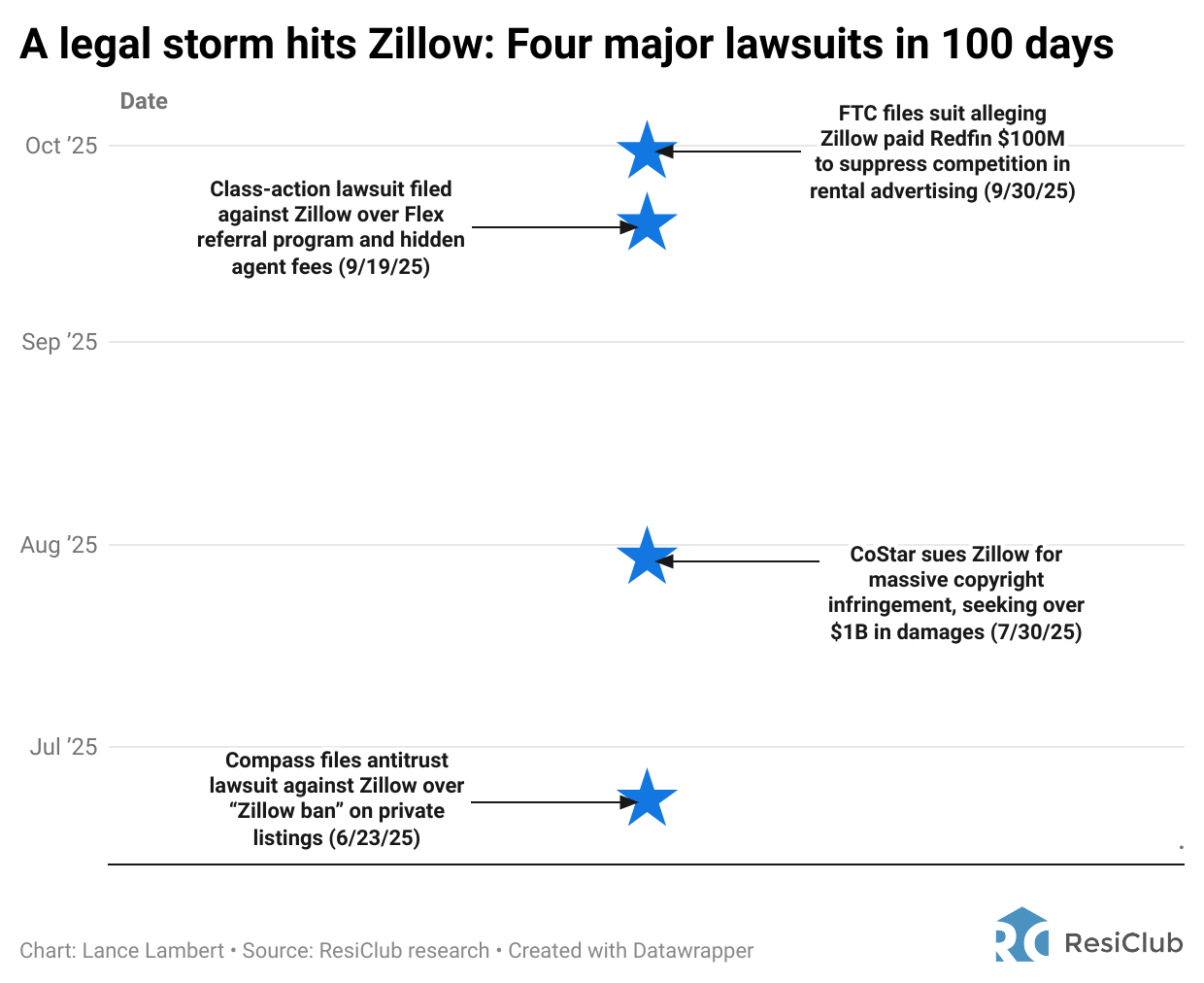

- A legal storm hits Zillow: Four major lawsuits in 100 days

A legal storm hits Zillow: Four major lawsuits in 100 days

The U.S. Federal Trade Commission filed a lawsuit on Tuesday, alleging that Zillow violated antitrust laws by paying Redfin $100 million to exit the rental listings market.

Today’s ResiClub letter is brought to you by Lennar Investor Marketplace!

There’s no better place to start looking for a promising SFR investment than on Lennar Investment Marketplace, an online platform that offers more than 2,000 rental-ready, investment-friendly homes. These properties span a wide range of 90+ locations nationwide, from bustling urban centers to serene suburban neighborhoods, providing a diverse portfolio depending on your strategies and preferences.

Each home is carefully selected and vetted to ensure it meets Lennar's high standards, making them attractive options whether you’re a seasoned investor or new to the real estate market. As a member, you can access a real-time underwriting dashboard, institutional-quality rental comps and area demographics for each listing.

Plus, you get end-to-end purchasing support, including pre-negotiated financing, property management, insurance and title services through Lennar's affiliates.¹ From initial evaluation all the way to closing, investing with Lennar is seamless and efficient.

A legal storm hits Zillow: Four major lawsuits in 100 days

Zillow is facing mounting legal battles—including a lawsuit today brought by the Federal Trade Commission alleging that Zillow paid rival Redfin $100 million to exit and stop competing in the online apartment rental listings market.

The FTC claims the arrangement—framed publicly as a “partnership”—was in fact an unlawful anticompetitive agreement that eliminated Redfin as a meaningful competitor in the online rental space. According to the complaint, filed in U.S. District Court for the Eastern District of Virginia, the February 2025 deal required Redfin to terminate its advertising contracts, step away from competing in multifamily property advertising for up to nine years, and act solely as a syndicator of Zillow’s rental listings.

The FTC alleges the arrangement not only harmed Redfin employees—hundreds of whom were laid off—but also renters and property managers, who now face reduced competition, higher costs, and fewer innovations in rental search platforms.

“Paying off a competitor to stop competing against you is a violation of federal antitrust laws.”

“Zillow paid millions of dollars to eliminate Redfin as an independent competitor in an already concentrated advertising market—one that’s critical for renters, property managers, and the health of the overall U.S. housing market. The FTC will do our part to ensure that Americans who are looking for safe, affordable rentals receive all the benefits of robust competition between internet listing services like Zillow and Redfin.”

The suit is the fourth major legal challenge filed against Zillow in just over three months, underscoring growing scrutiny of the company’s business practices.

—> June 23, 2025: Compass filed an antitrust lawsuit alleging Zillow’s “ban” on private listings was anticompetitive and harmed brokerages.

—> July 30, 2025: Commercial real estate giant CoStar sued Zillow for copyright infringement, seeking more than $1 billion in damages.

—> September 19, 2025: A class-action lawsuit was filed against Zillow, accusing the company of hiding agent fees within its Flex referral program.

—> September 30, 2025: The FTC filed its suit alleging Zillow’s $100 million agreement with Redfin was designed to suppress competition in rental advertising.

The rapid-fire succession of lawsuits—spanning copyright, antitrust, consumer protection, and federal enforcement—has put Zillow under one of the most intense legal spotlights in its corporate history.

The outcomes could ripple well beyond Zillow itself, potentially influencing how much choice, transparency, and information consumers have when navigating the housing market. This will be something to watch in 2026 and beyond.

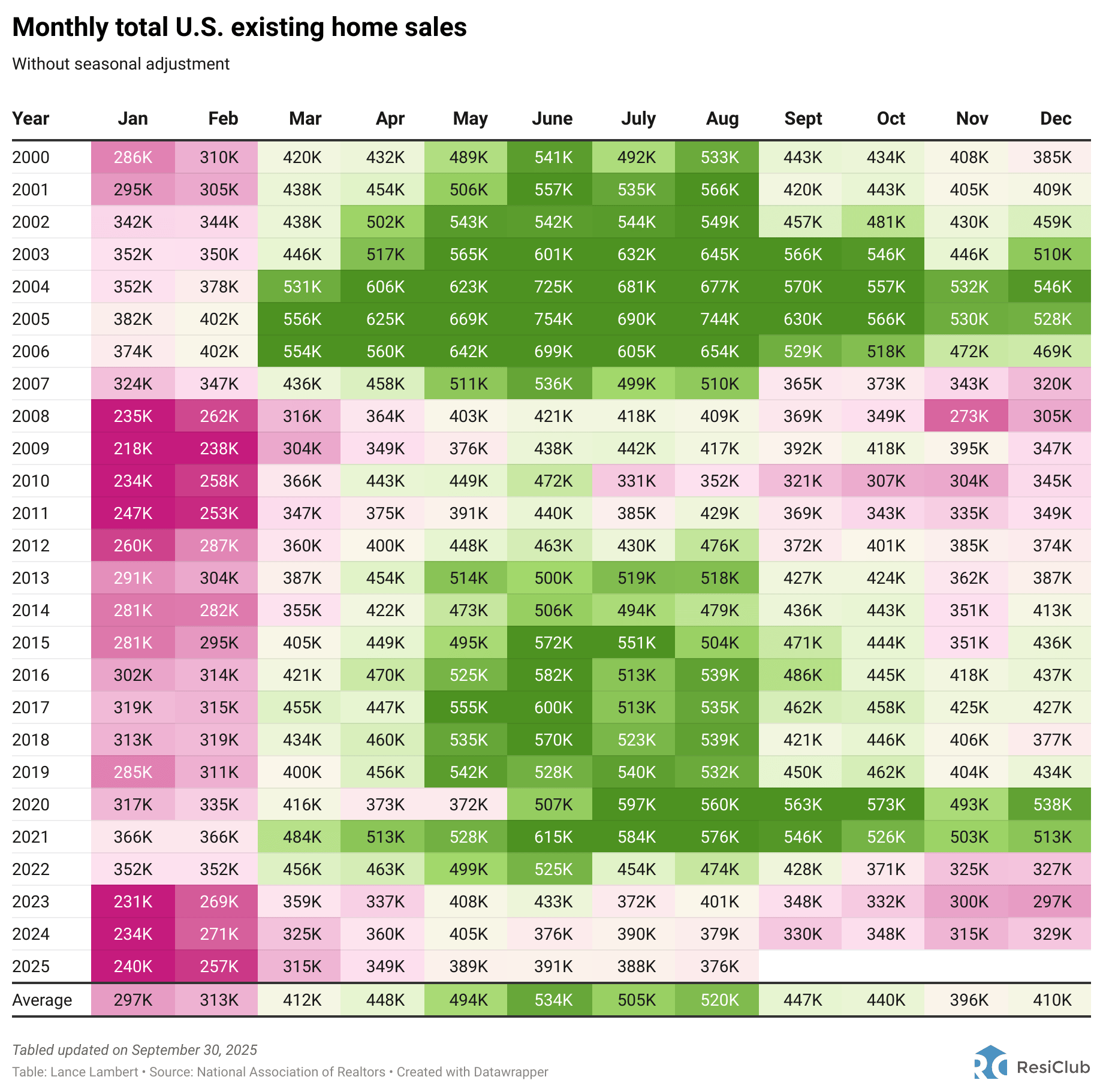

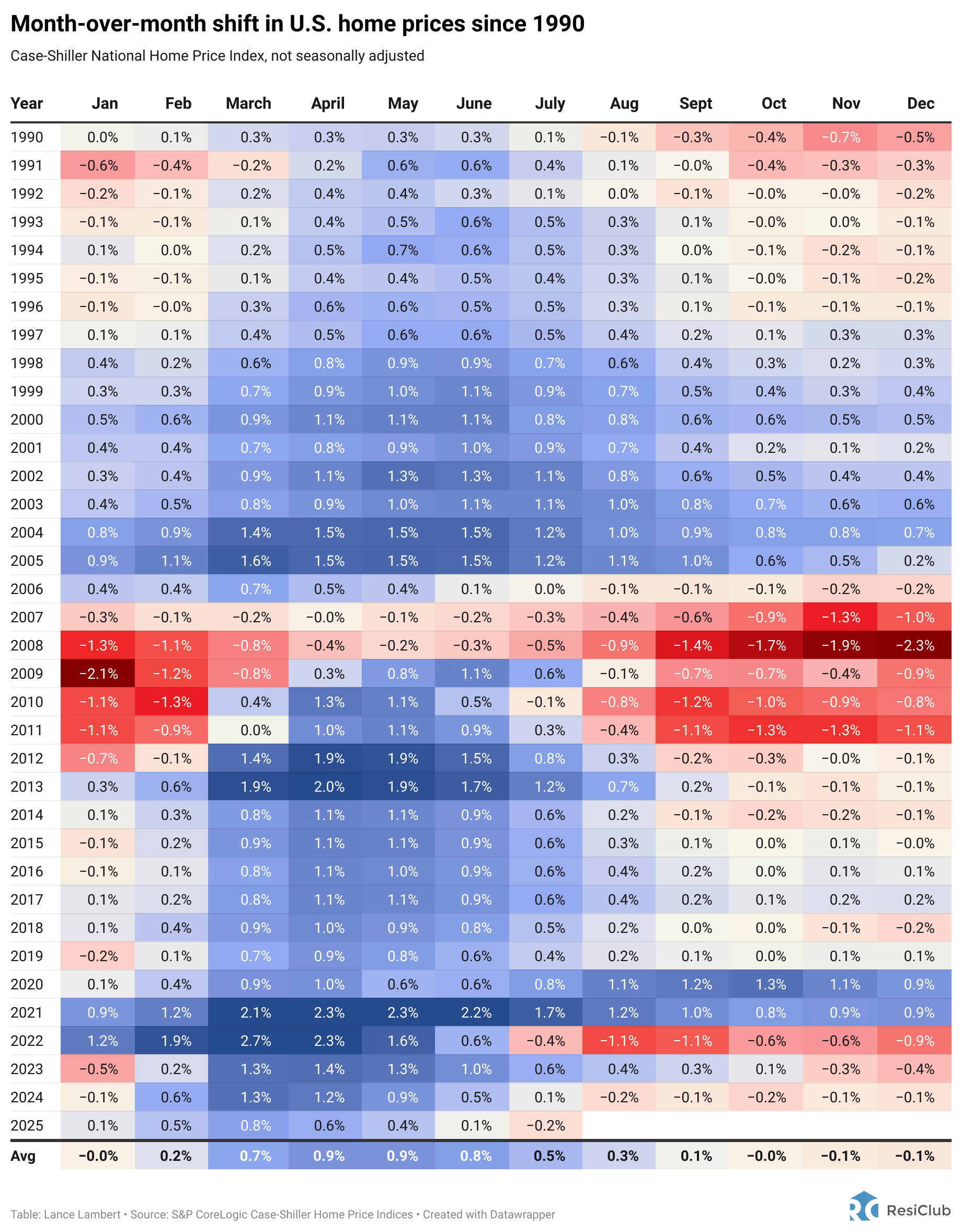

Case-Shiller reports

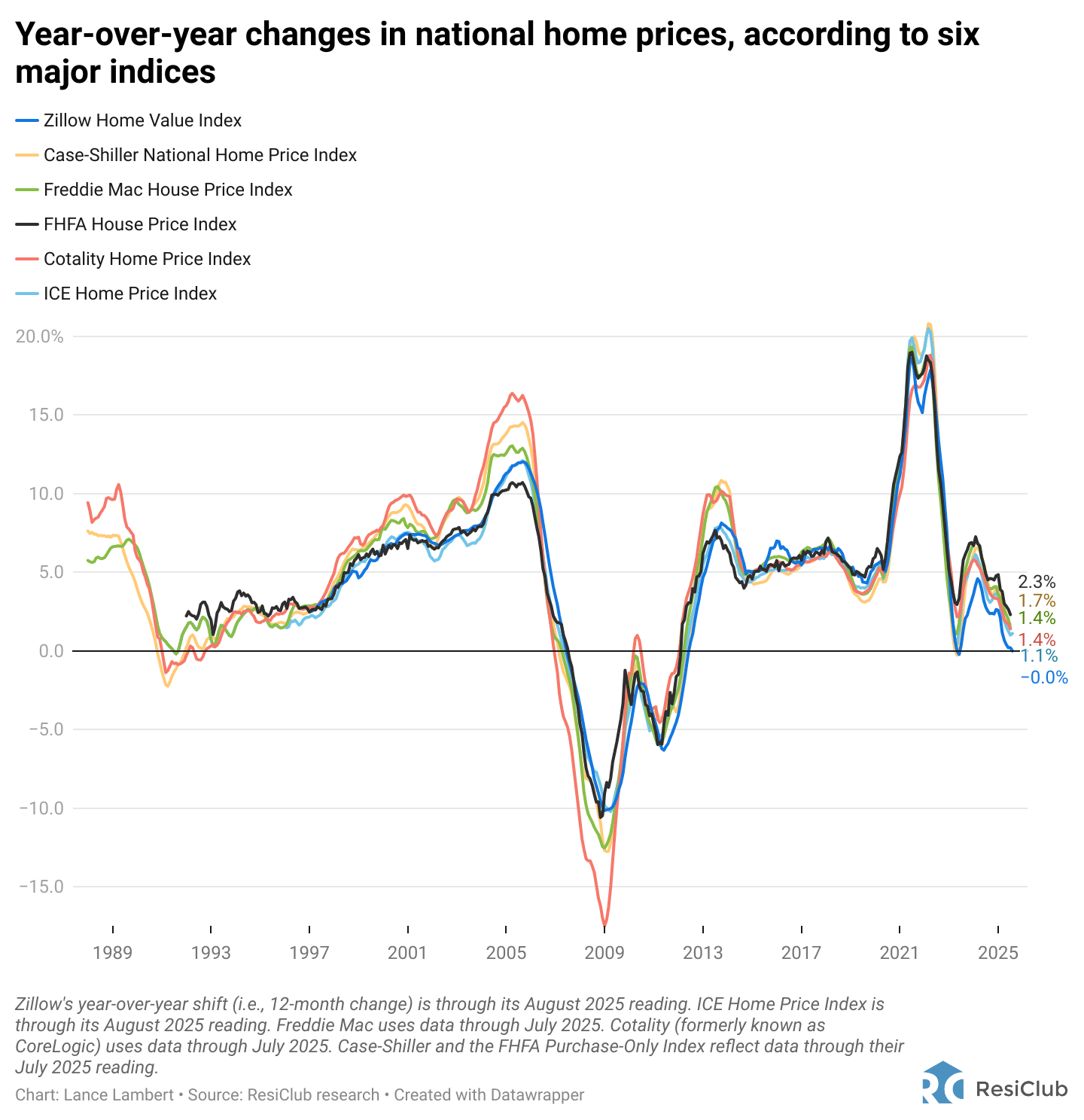

On Tuesday we learned that U.S. home prices, as measured by Case-Shiller, fell -0.2% month-over-month between the June 2025 and July 2025 reading. That's a weak print for that seasonal window.

Year-over-year: +1.7%

Since the 2022 peak: +7.5%

Since March 2020: +53.9%

On a year-over-year basis, nationally aggregated home prices have been softening this year across the 6 major indices tracked by ResiClub.

That includes U.S. home prices as measured by Case-Shiller, which today decelerated from +1.9% year-over-year to +1.7% year-over-year.

Existing home sales

Turnover remains constrained in the existing-home market. Indeed, you’d have to go back to August 2010 to find an August with fewer U.S. existing-home sales than in August 2025